34+ can i deduct my mortgage interest

Internal Revenue Service Home Help Interactive Tax Assistant Can I Deduct My Mortgage-Related Expenses. Web Used to buy build or improve your main or second home and.

Can I Deduct Mortgage Interest

Web A mortgage calculator can help you determine how much interest you paid each month last year.

. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. I know that on schedule E your deductions are limited to mortgage interest property taxes maintenance. You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt.

You can claim a tax deduction for the interest on the first. Secured by that home. Web If youre buying or refinancing a home especially if its your first home the loan is usually secured by the home youre buying or refinancing The home with the secured loan must.

Web If your mortgage was in place on December 14 2017 you can deduct interest on a debt of up to 1 million 500000 each if youre married and file separate. If your mortgage originated between October 13 1987. Web The mortgage interest tax deduction can make borrowing money to buy a home slightly less of a financial burden especially if you have a high income and a large.

The home mortgage interest deduction allows. Web Homeownership comes with several perks including the ability to deduct the interest you pay on your mortgage. First the deduction is only available if the policy is owned by an individual or a business.

Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest. Web Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web When it comes to tax deductions for mortgage interest since the 2018 Tax Cuts and Jobs Act single filers and those married filing jointly can deduct the interest. Web How much of a mortgage is tax deductible. Web From 2018 onwards the principal limit in which mortgage interest can be deducted has been reduced from 1000000 to 750000.

TaxInterest is the standard that helps you calculate the correct amounts. Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit. Web Benefits of the mortgage interest deduction The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay.

Homeowners who bought houses before. For married taxpayers filing separate returns the cap. Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations.

Web Can I Deduct My Mortgage-Related Expenses. Web If you took out your mortgage on or before October 13 1987 your mortgage interest is fully deductible without limits. Web Why cant you deduct your full mortgage payment on Schedule E.

For married taxpayers filing a separate return. Web As long as your adjusted gross income doesnt exceed 109000 or 54500 if married and filing separately you can deduct some or all of your mortgage insurance. Web Mortgage interest deduction limits The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Web Yes there are a few drawbacks to deducting life insurance on taxes. Get The Answers You Need Here. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Mortgage Interest Deduction Save When Filing Your Taxes

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Mortgage Interest Deduction Save When Filing Your Taxes

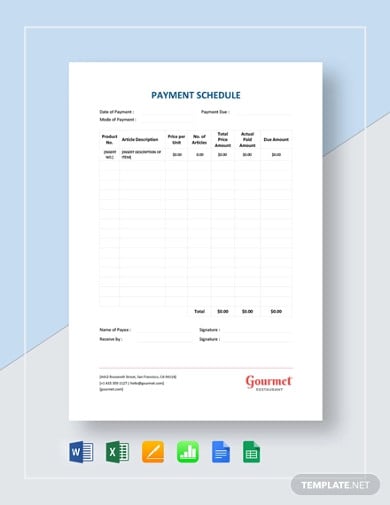

34 Payment Schedule Templates Word Excel Pdf

Calameo The Good News June 2010 Broward Issue

Free 3 Debenture Pledge Agreement Samples In Pdf Ms Word Apple Pages Google Docs

Can You Claim Mortgage Interest On Taxes Pocketsense

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Best Real Estate Tax Tips

Mortgage Interest Deduction Bankrate

Can I Deduct My Mortgage Interest Even If I Didn T Work During That Year

Free 34 Loan Agreement Forms In Pdf Ms Word

Mortgage Interest Deduction How It Calculate Tax Savings

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Tax Deduction Guide Nextadvisor With Time